Serious Illnesses Call for Serious Protection

Serious Illnesses Call for Serious Protection

Critical Illness Coverage Keeps You Financially Prepared

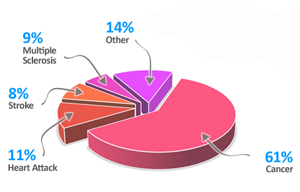

A serious illness can have a huge impact on more than just your health – it can also hurt your finances. Would you have the money to protect all you’ve worked for if you were to have a heart attack, stroke or other critical illness?

Critical illness insurance complements your major medical coverage by providing a lump-sum benefit if you’re diagnosed with a covered critical illness, such as:

- Heart attack (myocardial infarction)

- End stage renal failure

- Coronary artery bypass surgery

- Stroke

- Major organ transplant

You can use this benefit to help cover everyday living expenses or other costs related to your critical illness, such as home modifications, travel expenses and rehabilitation charges. You may receive additional benefits if you’re diagnosed with more than one critical illness.